Understanding the Stock Market: A Friendly Guide for 2025

What Is the Stock Market?

When people hear the term stock market, it often conjures up images of bustling trading floors, flashing price tickers, and investors shouting buy and sell orders. While that’s not entirely wrong, the stock market is actually much broader, more structured, and more influential than what we usually see in movies.

At its core, the stock market is a marketplace where buyers and sellers trade shares of publicly listed companies. A share (also called a stock) represents a small unit of ownership in a company. If you own shares of a company like Apple or Tesla, you essentially own a slice of that business no matter how small.

But the stock market is more than just buying and selling shares. It’s a vital component of the global economy that influences investment, wealth creation, and even government policies.

Think of the stock market as a giant meeting point between two main groups:

- Companies that need capital (money) – Businesses sell shares of ownership through an Initial Public Offering (IPO) to raise funds. These funds are then used to expand operations, launch new products, or pay off debt.

- Investors who want to grow their money – Ordinary people, institutional investors, and even governments buy those shares hoping their value will rise over time, or to earn dividends.

This dual purpose makes the stock market a win-win system when functioning properly: companies get funding, and investors get opportunities for returns.

The Two Main Types of Stock Markets

When we talk about the stock market, we’re usually referring to two key parts:

- Primary Market

- This is where companies sell shares directly to investors for the first time, through IPOs.

- For example, when Airbnb went public in 2020, it was an event in the primary market.

- Secondary Market

- After the IPO, those shares are traded between investors on exchanges like the New York Stock Exchange (NYSE) or Nasdaq.

- This is where the majority of day-to-day trading happens.

So when people say “the stock market went up today,” they’re usually talking about activity in the secondary market.

Why the Stock Market Exists

The stock market exists for three big reasons:

- Capital Formation

It provides companies with access to the funds they need to grow. Without stock markets, businesses would struggle to raise large sums of money quickly. - Investment Opportunities

It gives individuals, institutions, and governments a chance to grow wealth by investing in businesses with potential. - Economic Indicator

Stock markets often reflect the health of the economy. Rising markets generally signal optimism about growth, while falling markets often reflect uncertainty or downturns.

For instance, when the S&P 500 a benchmark index of 500 large U.S. companies performs well, it’s often seen as a sign that the broader economy is doing well too.

How the Stock Market Works Day to Day

The stock market is structured around stock exchanges like NYSE in the U.S., London Stock Exchange (LSE) in the U.K., or Bursa Efek Indonesia (BEI) in Jakarta. These exchanges provide a regulated environment where trades happen transparently.

- Prices of stocks fluctuate constantly due to supply and demand:

- If more people want to buy a stock (demand) than sell it (supply), the price rises.

- If more people want to sell than buy, the price falls.

- What drives this demand and supply? A mix of factors like:

- Company performance (earnings, product launches, leadership changes)

- Economic indicators (inflation, GDP growth, interest rates)

- Investor sentiment (fear, optimism, speculation)

- Global events (wars, pandemics, technological breakthroughs)

Even if you don’t invest directly, the stock market still affects you. Pension funds, insurance companies, and even banks invest heavily in stocks. When markets rise, the value of these funds increases, which can benefit your retirement savings or loan interest rates. Conversely, market crashes can ripple through the economy, leading to job cuts, reduced consumer spending, and slower growth.

A classic example is the 2008 financial crisis, which began with a collapse in U.S. housing and financial stocks but spread across the globe, impacting millions of jobs and livelihoods.

Why Understanding the Stock Market Matters

The stock market isn’t just for the wealthy or financial professionals. With apps and platforms making investing more accessible, more people are entering the market every year. Understanding its basics helps you:

- Make informed financial decisions

- Build long-term wealth

- Stay prepared for economic shifts

Even if you’re not actively trading, knowing how the stock market works gives you an edge in navigating the modern economy.

In essence, the stock market is a powerful engine of growth and opportunity, both for businesses and for individuals. It brings together companies seeking capital and investors seeking returns, shaping the financial world we live in today.

Whether you view it as a tool for personal investment, a measure of economic health, or simply a fascinating system that drives modern capitalism, the stock market plays a role in everyone’s life whether they know it or not.

2. How Stock Prices Are Set

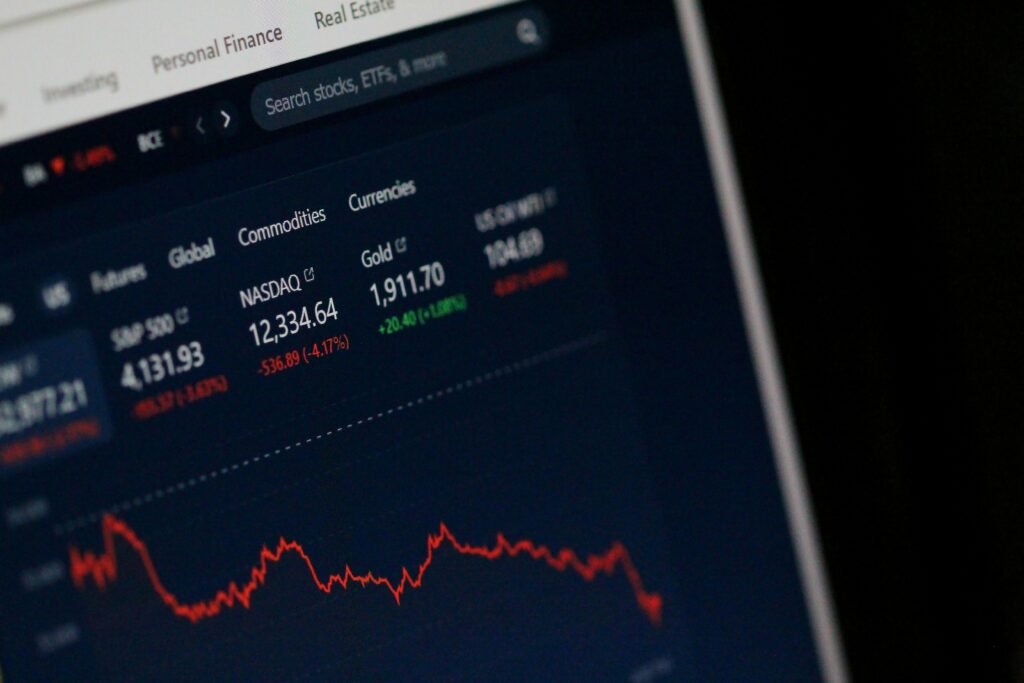

Stock prices fluctuate every second, driven by supply and demand. If more people want to buy a stock than sell it, the price goes up; if more people want to sell than buy, the price drops. In the long run, a stock’s value tends to reflect the company’s profitability and future growth potential (td.com).

3. Why Global Markets Are Buzzing in 2025

The stock market isn’t just a local race it’s global. In 2025, global markets have been shining brighter than U.S. stocks. Countries like Greece and Poland are seeing stellar ETF returns (up 55–58%), while U.S. markets like the S&P 500 rise by a modest 7% (Investopedia). Investors are shifting toward international opportunities thanks to better valuations, a weaker dollar, and attractive economic prospects (MarketWatch, Reuters).

4. What’s Fueling Market Optimism?

Several developments are boosting the stock market’s momentum:

- AI and Corporate Earnings: Strong earnings from tech giants and sustained investment in AI are bringing bullish vibes to equity markets (Investopedia, Business Insider).

- Market Resilience Amid Recession Fears: Despite concerns about possible economic downturns, markets remain upbeat, especially with AI leading the growth narrative (Barron’s).

- European Strength: Europe’s markets are gaining attention for their robust performance and promising macroeconomic outlook, while the U.S. continues to dominate in capital raising (The Wall Street Journal, The Australian).

- Strong Mid-Year Outlooks: Firms like J.P. Morgan and Russell Investments expect moderate yet positive global growth, suggesting a soft landing rather than a recession in 2025 (JPMorgan, russellinvestments.com).

5. Stock Market as a Learning Opportunity

- For beginners, investing in the stock market can be both exciting and daunting. Here’s how to get started:

- Understand the basics: Companies issue stock when they need capital. Investors buy stocks hoping the company succeeds and delivers returns via dividends or price appreciation (Bankrate).

- Educate yourself: Learn trading concepts like support, resistance, moving averages, and momentum indicators (Reddit).

- Diversify: Spread your investments across geographies, sectors, and asset types. 2025’s performance shows how international diversification can sweeten your portfolio mix (Schwab Brokerage, AP News).

6. Outlook: What Lies Ahead?

Growth Slows but remains positive: The U.S. economy may grow modestly (~2%), while emerging markets and other regions continue to show promise (deutschewealth.com, Schwab Brokerage).

Mutated Gains: Although past years saw strong bullish runs, 2025 may bring more restrained returns, with both growth and value stocks presenting opportunities (Morgan Stanley).

Staying Alert: Analysts recommend being prepared for geopolitical and policy-driven shifts. Oil markets, tariffs, and global tensions remain watchpoints (Barron’s, Invesco).

The stock market is a dynamic, global ecosystem where supply, demand, investor sentiment, and economic signals drive price movement. In 2025, the interplay of AI-driven optimism, international equity outperformance, and steady fundamentals paint a cautiously bright picture. Whether you’re a newbie or a seasoned investor, staying informed, diversified, and balanced remains your best strategy.